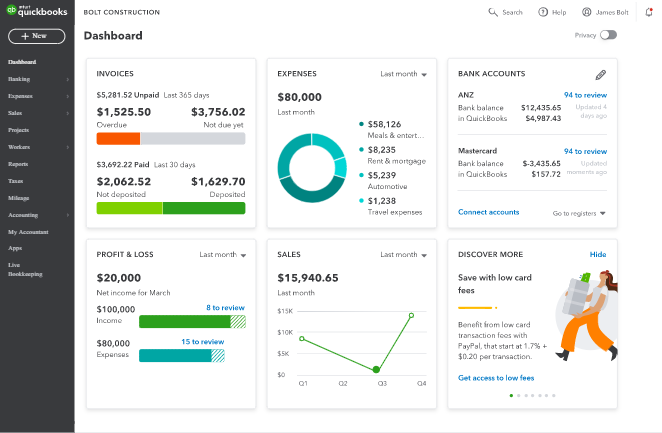

Business owners can run a financial report in seconds to review profitability, compare revenue and costs, check bank and loan balances, and predict tax liabilities. After selecting the proper category, transactions begin to populate the business’ financial statements.

#Best rated accounting software for small business Offline#

Users can quickly send invoices, accept online and offline payments, and generate informative financial management reports with a few clicks of the mouse. Kashoois another great tool for small business owners who don’t need complex or confusing features and functionality in their accounting software. Pricier plans include reports for accounts receivable and payable, budgeting, inventory, sales, profitability, and more. Sage’s customer service is very accessible, which is good news for freelancers and self-employed people who don’t have accounting expertise. Melio lets you enter a vendor’s information manually, upload a file with that date or snap a photo of an invoice. It also has nearly 40 app integrations so it can be used with the software you’re already using. We chose Zoho Books as our best accounting software for automation because it offers robust accounting features and automation for bank feeds, categorizing, invoices, and more. This one-time fee ranges from $150 to $500 depending on how basic or advanced of a plan you choose.

0 kommentar(er)

0 kommentar(er)